Table Of Content

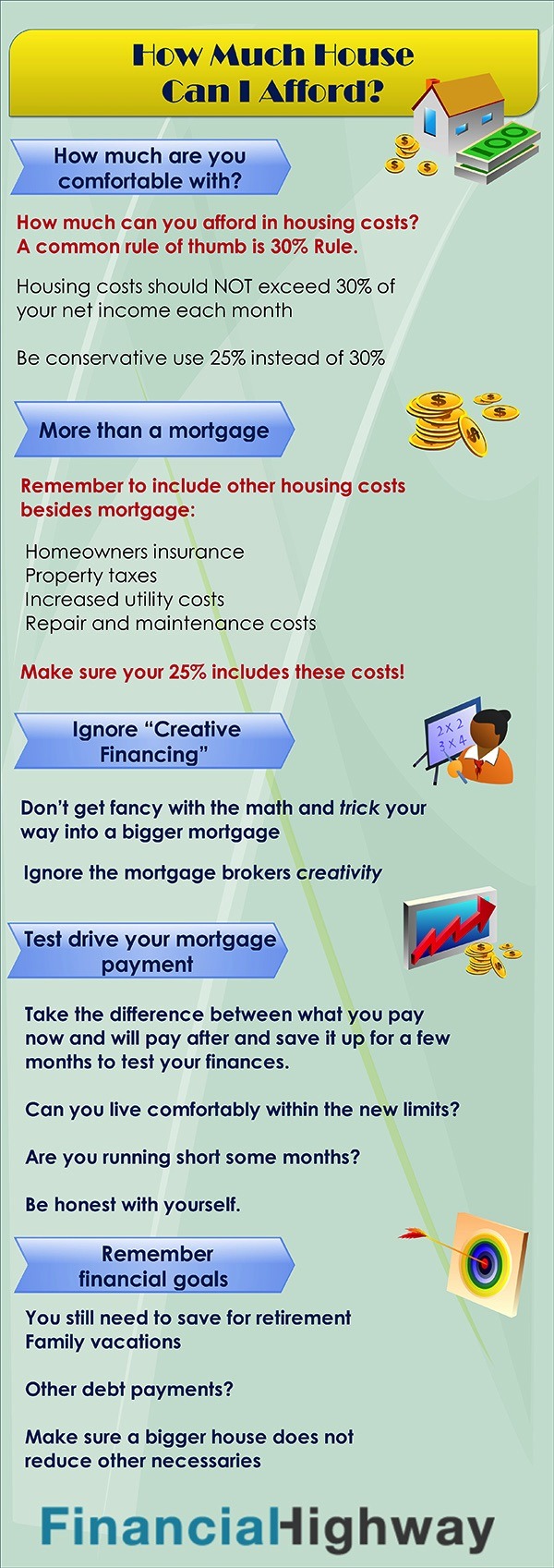

Everyday expenses and housing costs, including rent and mortgage payments, are the biggest reasons why people are unable to save for retirement. In the last decade, the housing market has seen explosive growth. Eleven consecutive times indirectly caused mortgage rates to surge and homeowners to hunker down, giving way to an inventory crunch.

Your Monthly Budget

This might mean choosing a smaller home or choosing a different neighborhood than you originally planned. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. Learn Dave Ramsey’s roadmap to buy, sell and invest in real estate the right way, so your home can be a blessing, not a burden. Letting go of the idea of a luxury kitchen or gleaming hardwood floors might be tough, but it’s worth it to avoid getting in over your head financially.

Buying Options

You can get a conventional loan (a loan not backed by a government agency) for as little as 3% down. Take some of your extra money and put it toward your mortgage principal every month to pay off the loan faster. Suppose you bought the same $200,000 house as above with the 15-year fixed mortgage at 5% but the mortgage interest rate changed to 6.25%. Gross monthly income is the total amount of money you earn in a month before taxes or deductions.

How Much House Can I Afford? Home Affordability Calculator

Once you begin the mortgage-application process, you’ll have to wait several weeks or longer for closing day to arrive. During this time, it’s important to remain financially disciplined and not make any major purchases or changes that could impact or decrease your credit profile. Lenders are looking for stability — if you switch jobs or apply for a bunch of new credit cards, for example, they could very well change their mind about approving your loan. Amy Fontinelle is a freelance writer, researcher and editor who brings a journalistic approach to personal finance content. Amy also has extensive experience editing academic papers and articles by professional economists, including eight years as the production manager of an economics journal.

Is your credit score in great shape, and is your overall debt load manageable? Do you have enough savings that a down payment won’t drain your bank account to zero? If your personal finances are in excellent condition, a lender will likely be able to give you the best deal possible on your interest rate. A house is one of the biggest purchases you can make, so figuring out how much you can afford is a key step in the home-buying process.

How Much Should I Have Saved When Buying a Home?

If you have a relatively modest income for the area where you’re buying, you might be in line for cash help. Many people, especially those with young children, are very focused on buying a property in the right school district. This can lead to much higher home prices that might be out of your budget.

Flood Insurance

Perhaps you need to make a budget and a plan to knock out some of your large student or car loans before you apply for a mortgage. Or you wait until you get a raise at work or change jobs to apply for a mortgage. At a minimum, it’s a good idea to be able to make three months’ worth of housing payments out of your reserve, but something like six months would be even better. That way, if you experience a loss of income and need to find a new job, or if you decide to sell your house, you have plenty of time to do so without missing any payments.

Explore more mortgage calculators

Make six figures? Here’s how much you must earn to afford a house in 2024 - LiveNOW from FOX

Make six figures? Here’s how much you must earn to afford a house in 2024.

Posted: Sat, 27 Apr 2024 00:45:54 GMT [source]

Eligible buyers should also check out the Department of Housing and Urban Development (HUD)’s Good Neighbor Next Door Program. This offers a discount of 50% off the list price of a home to law enforcement officers, teachers (pre-Kindergarten through 12th grade), firefighters, and emergency medical technicians. “In return, an eligible buyer must commit to live in the property for 36 months as his/her principal residence.” The catch? The home must be in a designated revitalization area, which may not currently be a desirable neighborhood. And, finally, you could always ask a relative to contribute to your closing costs if you know someone who would be willing to help out.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Biden has tried to court older voters by regularly promoting a $35 price cap on insulin for people on Medicare. He trumpets Medicare’s powers to negotiate directly with drugmakers on the cost of prescription medications. When you’re trying to get a mortgage, each of these pieces needs to fall in the right place to put the puzzle together and buy a home.

You can use a DTI calculator to help you figure out where you stand right now. In fact, student loans that are in deferment can hurt you by increasing your debt even though you’re not required to make monthly payments. Your estimated annual property tax is based on the home purchase price.

While an upfront funding fee is required on these loans, your down payment can be as little as zero down without paying PMI. Mortgage interest is the cost you pay your lender each year to borrow their money, expressed as a percentage rate. Once again, the answer to this question will depend on where you want to buy and what kind of property you want. Your credit score and DTI will also be important factors in determining what interest rate and loan terms you get from the lender. For example, with a $100,000 annual salary, you can afford a $300,000 house based on the maximum multiplier.

Credit scores range from 300 to 850 and the higher yours is, the better the rate you'll be offered. Paying off one credit card to eliminate a few hundred dollars in monthly payments could help you get approved for a higher loan amount. As if buying a house didn't already feel unattainable already, a recent report from Redfin shows just how unaffordable housing is right now.

Look for ways to make groceries cheaper by cutting coupons and making a meal plan based on sale items. However, with a smart budget in place before house hunting, you might be able to afford that home sooner than later. This strategy allows you to negotiate a price on a place that is below market value while you develop a plan to improve it and build equity in it quickly with improvements. All you need is a little planning, so we asked real estate experts for their tips on how to afford a house. Start saving up a strong down payment and use the free EveryDollar app to track your budget every month. Okay, I’m super impressed you’re already thinking about how to afford a house!

Some programs make mortgages available with as little as 3 percent or 3.5 percent down, and some VA loans are even available with no money down at all. Home sale prices over the last 10 years have doubled, according to Redfin, and have climbed about 50% since 2019. Not only do potential buyers have to clear the barrier of high mortgage interest, they also have to reckon with home prices remaining near record highs. This reality is unlikely to reverse anytime soon, too, with the Fed continually pushing back its first rate cut and Fannie Mae predicting a 4.8% home price increase by the end of 2024. Simultaneously to the swift pivot in mortgage rates, home values have been spiking.

Many homebuyers are surprised to learn that lenders factor your future student loan payment into your monthly debt payments. After all, deferment and forbearance only grant borrowers a short-term reprieve—much shorter than your mortgage term will be. Once you close on your home loan, your monthly mortgage payment may well be the biggest debt payment you make each month, so it’s important to make sure you can afford it.

The Rocket Mortgage® Home Affordability Calculator gives you the option to see how much house you can afford, or how much cash you need for your down payment and closing costs. However, just because you’re approved for a certain amount doesn’t mean you should buy a house with that home price. Instead, you’ll want to take a close look at your financial health, including your household income and monthly expenses, and make sure to set a firm budget once you begin your home search. If you go with this plan it’s important to make sure your mortgage terms don’t include a penalty for paying off the loan early. This is known as a pre-payment penalty and lenders are required to disclose it.